FAQ

※ The companies mentioned in the document will be referred to as following:

Doosan Enerbility→Enerbility, Doosan Bobcat→Bobcat, Doosan Robotics→Robotics

-

-

Q2

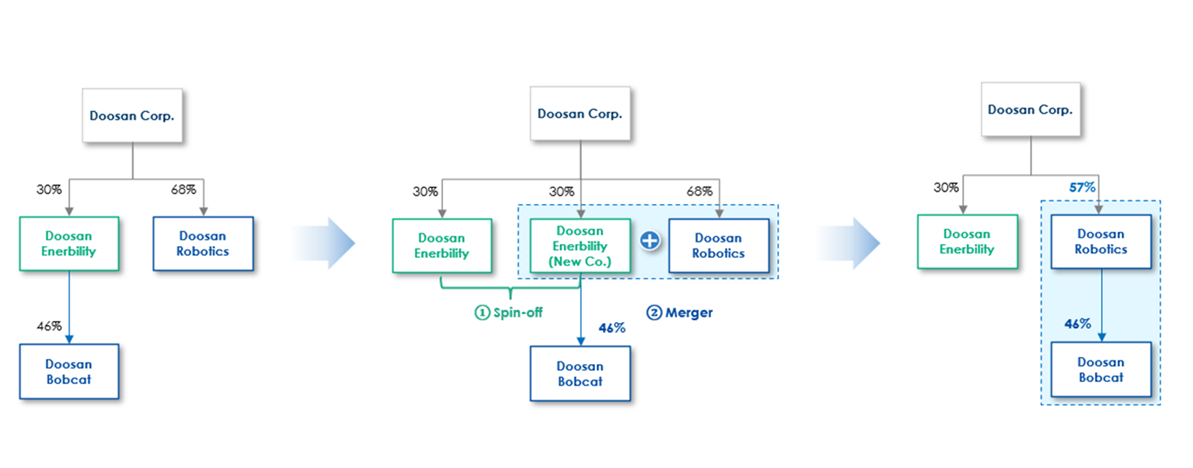

What is the rationale for still proceeding the Bobcat spin-off from Enerbility and merger with Robotics?

- For Enerbility, this business reshaping is a strategic move aimed at securing financial resources and timely investments to capture market shares in emerging opportunities within the energy sector, including nuclear power plant, SMR, gas turbine, hydrogen turbines, and offshore wind power. Upon completion of this plan, Enerbility will secure more than KRW1.0tn of additional investment capacity including the transfer of KRW700bn debt to Robotics. For Bobcat, it is difficult to expect business synergies with Enerbility as two companies operate in completely different sectors. If Bobcat is placed under Robotics through this reshaping, various synergies will be generated. Bobcat’s competitors in global machinery market such as Caterpillar and John Deere are acquiring robotics companies to pursue synergies in automation, AI, and unmanned systems. For Robotics, by combining business with Bobcat, which has a strong network and infrastructure in the US and European markets, it can significantly accelerate its growth.

-

Q2

-

-

Q3

The stated objective of transferring Bobcat to Robotics is to secure investment capacity for Enerbility. Aren’t there other alternatives to raise capital, such as securing loans with Doosan Bobcat shares as collateral or rights offering?

- We have determined that the most practical and feasible approach is the proposed spin-off merger, maintaining the company’s financial soundness, while aligning with the long-term objective of boosting the credit rating. Additional borrowings will result in increase in debt and interest expense, which would aggravate the financial soundness of the company. This would likely result in a fall in credit rating and a reduction in existing credit lines. In the case of rights offering, we have excluded this option as expected dilution would potentially harm the interests of the minority shareholders. After careful consideration of financial stability and credit ratings, we have proposed the spin-off merger, which also benefits existing Enerbility shareholders through increase in Robotics share value from potential synergies.

-

Q3

-

-

Q4

Has the option of selling Bobcat to raise capital been considered?

- Option of selling Bobcat to an external entity was not considered as Bobcat was deemed a key asset within the group’s portfolio. Although some have suggested selling Bobcat to Robotics, whether internal or external, the proceeds from the sale would be attributed to the company, not directly benefitting Enerbility shareholders. For those who may still wish to speculate on the potential sale, the key focus would be the value reflecting a control premium. Therefore, in the revised proposal, we have incorporated a ‘control premium that could be expected in a M&A transaction’ to recalculate Bobcat’s value higher. Furthermore, as Enerbility shareholders will receive shares in Robotics, they will have the opportunity to benefit from potential stock price increases driven by the synergy between Robotics and Bobcat. Since newly received Robotics shares can be sold at any time, it provides a direct benefit to shareholders unlike a company-level sale of Bobcat.

-

Q4

-

-

Q5

How has the spin-off ratio and merger ratio changed compared to the original proposal?

- First, the spin-off ratio has been changed as follows: while the original proposal followed the traditional method of applying the net asset value, the revised proposal applies the market value. Although the spin-off does not change the total value of shares owned by shareholders, this change addresses the market concern that the previous net asset value based ratio excessively reduces the shares compared to the market capitalization. As a result, the spin-off ratio has been revised from 0.247 to 0.115. Consequently, the merger ratio, which determines the number of Robotics shares to be allocated to Enerbility shareholders, now incorporates a ‘control premium’. The merger ratio was revised from 0.1276 to 0.3740 which increases the number of Robotics shares given to Enerbility shareholders. With the change in the spin-off merger ratio, an Enerbility shareholder holding 100 shares will receive 88.5 shares (previously 75.3 shares) and 4.33 Robotics shares (previously 3.15 shares). With the increased number of shares given to shareholders after the change of ratio, total share value increases by approximately KRW390,000 based on the closing price as of July 11th.

-

Q5

-

-

Q6

Couldn’t the company have applied this revised approach from the beginning?

- Previously, the reshaping plan had to take into account for the share swap plan between Robotics and Bobcat. Under relevant regulations, when both companies engaged in the share swap are listed such as Robotics and Bobcat, the valuation must be based on the market price. Therefore, when calculating the value of Bobcat during the spin-off from Enerbility, we had to use market price only to ensure the consistency of the overall transaction processes. However, with the withdrawal of the share swap plan between Robotics and Bobcat, we are no longer constrained to the previous requirement. As a result, Bobcat’s value has been recalculated by adding a control premium to the market value, similar to that expected in case of M&A transaction and we have also received an evaluation from an external assessment firm in compliance with relevant regulations.

-

Q6

-

-

Q7

The Financial Supervisory Service suggested valuation analysis of Bobcat using Discounted Cash Flow(“DCF”) or Dividend Discount Model(“DDM”). Were these analysis methods conducted?

- The intrinsic value of newly established company after a spin-off is assessed using both asset value and profit value. For the calculation of the profit value, valuation methodologies including DCF and DDM are generally used. However, there are certain limitations to these approaches. First, DCF and DDM models are built upon multiple subjective assumptions made by the evaluator, so the valuation results may vary significantly based on the evaluator. Additionally, these methods utilize key market indicators such as peer stock price, interest rate and market forecasts. Therefore, when there is a discrepancy between the market valuation of a listed company and the value calculated using these methods, it results in methodological contradiction. As so, applying DCF and DDM valuation methods for listed companies is rare in practice. External assessment firms including most of the accounting firms concluded that it is not feasible to use theses methods for the valuation of this transaction. Instead, the company opted to apply a valuation method that reflects a control premium in the market value, in consultation with the external assessment firm.

-

Q7

-

-

Q8

It has been stated that this reshaping plan will reduce Enerbility’s debt and enhance its financial capacity, yet there are concerns that the debt ratio will increase. Wouldn’t this mean worsening of the company’s capital structure?

- While the reshaping plan is expected to reduce liabilities by KRW1.2tn, the reduction in capital (KRW1.5tn) will be greater, temporarily increasing the debt ratio from 128% to 142%. However, additional investment capacity secured through this reshaping will be directed towards high-return future projects, which is expected to boost operating profits. As a result, we anticipate that the debt ratio will return to current levels in the short-term with further improvements in the future. In addition, aside from the debt ratio, other key financial stability indicators such as debt reliance, net debt/EBITDA, and EBITDA/interest coverage ratio are expected to improve with this spin-off merger.

-

Q8

-

-

Q9

Wouldn’t it be more beneficial for Enerbility to retain Bobcat as a subsidiary and continue to receive dividends?

- Dividend income is subject to annual fluctuations depending on its business performance. While dividends may increase from current levels, they could also decrease. On the other hand, if the funds secured through this business reshaping are invested in future growth engines, it is expected to generate much higher returns than the current dividend income. Higher profits will directly lead to an increase in shareholder value. Furthermore, current dividend income is insufficient to meet Enerbility’s investment needs.

-

Q9

-

-

Q10

Is the purpose of this business reshaping to strengthen Doosan Corporation’s influence over Bobcat?

- The question likely refers to whether this business reshaping strengthens Doosan Corporation’s control over Bobcat. However, its voting rights will remain unchanged at 46%. The difference lies only in which affiliate holds Bobcat shares (previously Enerbility, now Robotics) and there is no change in degree of control over management. It seems that the question pertains not to management control but to Doosan Corporation’s indirect ownership in Bobcat. More specifically, the question could be interpreted as whether the increase of indirect ownership in Bobcat will benefit Doosan Corporation in terms of higher dividend payout. It is true that Doosan Corporation’s indirect ownership in Doosan Bobcat will increase, but there are almost no tangible benefits from dividend for Doosan Corporation or the controlling shareholder. Even if Robotics were to receive dividends from Bobcat, the practical dividend income would likely be very limited due to interest expense incurred from the newly transferred debt (KRW700bn) and investment in new businesses. Therefore, even if Robotics were to distribute dividends to Doosan Corporation, the amount would be minimum. In other words, there is no chance for Doosan Corporation’s shareholders to benefit from ‘increased profit through Bobcat’s dividend’. For example, if Bobcat pays a dividend of KRW1,600 per share, Robotics would receive approximately KRW74bn (the same amount previously received by Enerbility). After deducting the KRW40bn in interest expenses generated from the debt transferred from Enerbility, the remaining KRW34bn could theoretically be distributed as dividends. Of this, it is expected that Doosan Corporation would receive KRW19bn. However, when factoring in the KRW19bn in interest expenses from the acquisition of Doosan Cuvex, which Doosan Corporation took on through this reshaping, the actual net profit from dividends for Doosan Corporation would effectively be zero.

-

Q10

-

-

Q11

[Robotics-Bobcat] Is there a plan for the Company to reinstate the share swap between Robotics and Bobcat in the foreseeable future?

- Following the spin-off merger, Robotics and Bobcat will prioritize enhancing enterprise value by leveraging synergies derived from the parent-subsidiary relationship. Pursuing the share swap transaction will be challenging without demonstrable synergies between the two companies, enhancements to legal and regulatory frameworks, and a robust consensus with shareholders and the market.

-

Q11

-

-

Q12

[Robotics-Bobcat] Has the potential acquisition of Robotics by Bobcat been evaluated?

- This is not a viable option for securing investment capacity for Enerbility, nor does it align with our current business reshaping strategy.

Furthermore, as Doosan Corp. is a holding company under the Korean Monopoly Regulation and Fair Trade Act (the “Fair Trade Act”), it is not feasible for second-tier subsidiary, Bobcat, to acquire Robotics under the current shareholding structure. According to the Fair Trade Act, a holding company’s second-tier subsidiary may only hold a stake in third-tier subsidiary if it holds 100% of the shares; however, since Robotics is a listed company, this structure is legally not feasible.

-

Q12